MARKET TRENDS

Europe Races to Refresh Its Sterilization Core

Hospitals across Europe race to modernize aging sterilization systems and keep pace with rising surgical demands

18 Oct 2025

Europe’s hospitals are reassessing their sterilisation infrastructure as ageing systems struggle to meet shifting clinical demands, rising instrument volumes and higher expectations for safety and efficiency. Administrators and industry analysts report increased long-term planning as facilities consider broad upgrades to sterilisation capacity.

Many hospitals rely on sterilizers installed more than a decade ago, creating a widening gap between older equipment and the needs of today’s surgical environment. More delicate devices, faster procedure turnover and larger instrument inventories are exposing bottlenecks in systems not designed for current workloads. Market analysts estimate that replacement cycles could lift Europe’s sterilisation market to about $4.4bn by 2030, driven by interest in equipment that offers consistent performance with lower resource use.

Manufacturers are adjusting their engineering priorities in response. Getinge has emphasised designs that work with the physical layout and flow of busy hospitals to reduce unnecessary handling. Steris has focused on standardising cycles and improving reliability, seeking to ease delays in reprocessing and reduce variation in turnaround times. Matachana Group has directed investment towards energy-efficient systems as hospitals look for measurable reductions in water and electricity consumption amid rising utility costs and environmental targets.

The trend is altering hospital planning and procurement. Rather than opting for incremental equipment swaps, many facilities are considering phased rebuilds that integrate ventilation, steam generation, cooling capacity and instrument flow into a single system. The approach reflects a view that effective sterilisation depends as much on supporting infrastructure as on the sterilizers themselves. Progress, however, is uneven. Smaller and rural hospitals often face capital constraints or limited space for expanded layouts and new utility connections.

Workforce pressures add to the challenge. Teams are handling larger inventories and more complex devices, leading hospitals to prioritise systems that simplify daily tasks, reduce physical strain and improve workflow predictability. Training requirements remain significant, particularly when moving from older steam-based units to newer hybrid or low-temperature technologies.

Despite these obstacles, the direction of travel is becoming clearer. Hospitals across Europe are treating sterilisation as a core component of surgical readiness rather than a background function. As infrastructure renewal, environmental performance and operational reliability move higher on executive agendas, sterilisation departments are gaining greater institutional focus, signalling a shift towards systems designed for contemporary clinical demands.

Latest News

30 Nov 2025

Fresh Capital Sparks Europe’s Cold Plasma Push26 Nov 2025

Robots Take the Lead in Hospital Hygiene21 Nov 2025

Europe Accelerates Shift Toward Smarter Sterilization24 Oct 2025

Europe Refreshes LTSF Rules As Manufacturers Watch Closely

Related News

INVESTMENT

30 Nov 2025

Fresh Capital Sparks Europe’s Cold Plasma Push

INNOVATION

26 Nov 2025

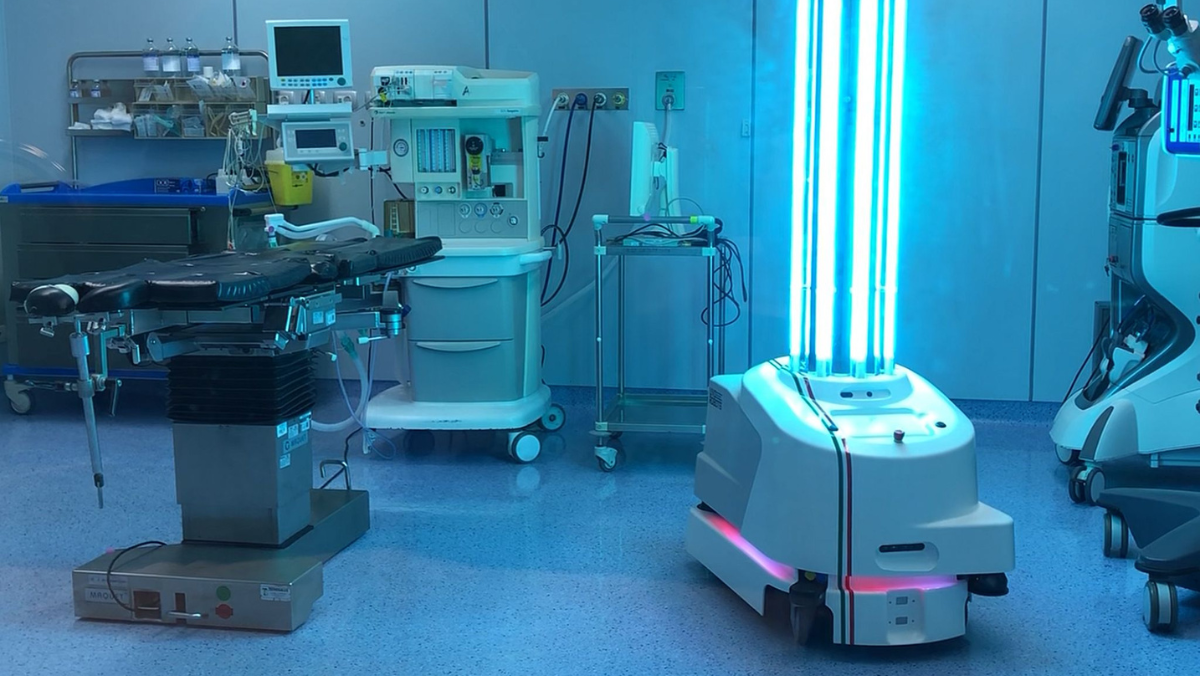

Robots Take the Lead in Hospital Hygiene

RESEARCH

21 Nov 2025

Europe Accelerates Shift Toward Smarter Sterilization

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.